INSTILLING

CLARITY & CONFIDENCE

IN YOUR FINANCIAL LIFE.

There's more to quality wealth management than just managing money.

At Caliber, we take the complex and confusing and make it simple.

INSTILLING

CLARITY & CONFIDENCE

IN YOUR FINANCIAL LIFE.

There's more to quality wealth management than just managing money.

At Caliber, we take the complex and confusing and make it simple.

WHY

CALIBER?

There’s more to quality wealth management than just managing money. It’s about making sense of all your financial matters and addressing the things you may be missing or unsure about. At Caliber Wealth Management, we take the complex and confusing and make it simple and straightforward. When you put the collective wisdom, experience, and capabilities of our full team to work for you, we help you move forward with clarity and confidence.

THE COMFORT EQUATION ™

Our proven, collaborative, 5 step process. Your life never stops evolving, so our process is ongoing and flexible.

FREEDOM OF FLEXIBILITY

Choose what services you need and your preferred method of working with us: in-person, online, or both.

OUTSTANDING CLIENT SERVICE

Client service, centered on you. At Caliber, you're supported by a team of professionals, dedicated to a premier level of service.

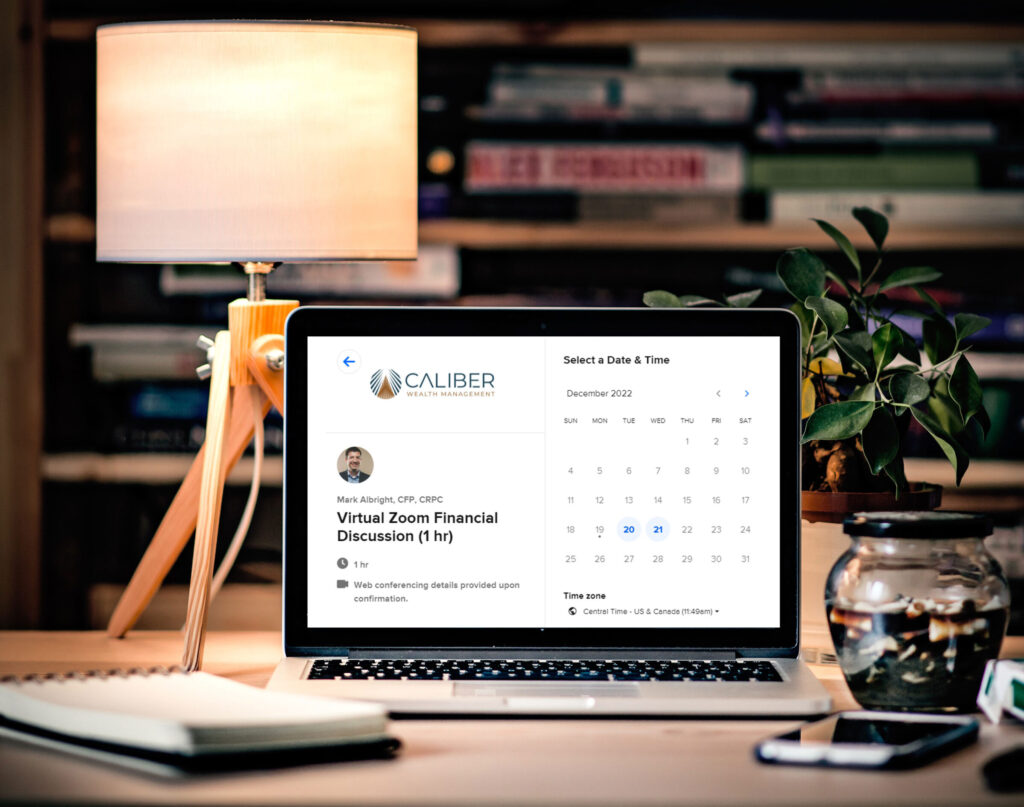

STAY CONNECTED

at your own convenience.

Online scheduling, easy to reach advisors, and 24/7 portal access make it easy to stay connected, both to your advisor and your account.

STAY CONNECTED

at your own convenience.

Online scheduling, easy to reach advisors, and 24/7 portal access make it easy to stay connected, both to your advisor and your account.

FEATURED

CONTENT

THERE'S MORE TO

EXPERIENCE.

At Caliber, you’re more than just a client. We provide the knowledge, know-how, and resources of a large-scale firm but with a small-town feel. Ultimate flexibility, top-tier client events, and industry-leading advisors are just the beginning. Becoming a Caliber client can open the door to possibilities within your finances you never thought possible. Click below to learn more about our services.

Investment advisory services provided by Caliber Wealth Management, LLC, a registered investment adviser.

This website is only intended for clients and interested investors residing in states in which we are registered to provide investment advisory services or exempt from registration. Please contact us to determine if the firm provides investment advisory services in the state where you reside. All content on this site is for information purposes only and should not be considered investment advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness.

Caliber Wealth Management, LLC and its representatives do not provide tax or legal advice and nothing herein should be construed as such. Always consult with your tax advisor or attorney regarding your specific circumstances.