Another Housing Bubble? By Alex Petrovic III

Recently, I have had conversations with several clients, friends, and my real estate agent wondering if this rise in housing prices is the formation of another bubble? My opinion is that we are not in another bubble.

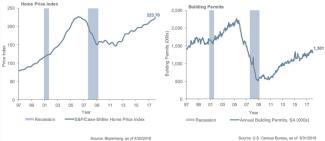

Broadly speaking, it looks more like a case of low supply and high demand. Home prices around the country, especially starter homes, have been bid up significantly the past few years. Recently though, some aspects of the housing market look to be cooling off. However, we think the good economy, low-ish interest rates, and a lack of supply will continue to push up home prices in the near-term, but probably not as robust as recent price growth. Below are some statistics and quotes that discuss both sides of this issue.

Here are couple of statistics to start with:

- The 1.48 million existing homes that were on the market for resale as of December 2017 is down 10% in the last year, down 19% in the last 5 years, and down 63% in the last 10 years (source: NAR). Repeat, down 63% in the last 10 years!!

- In the years 2010-16 following the global real estate crisis, 46% of the new homes built in the United States had at least 4 bedrooms (source: Federal Reserve Bank of St. Louis).

In a recent NPR MarketPlace interview with the CEO of Zillow, an online home listing service, CEO Spencer Rascoff affirmed that the housing market is hot, inventory is low and homes weren’t and aren’t being built fast enough to keep pace with demand.

A recent WSJ article echoed Rascoff’s sentiments. Source: Wall Street Journal, June 20, 2018.

A lot of the supply issue comes down to how few homes are being built even now, nine years after the recession ended. Tuesday, the Commerce Department reported that there were an annualized 1.35 million housing starts last month—up from 1.12 million a year earlier and the most since July 2007. But that was still below the levels that prevailed even in the 1970s, when the U.S. population was much lower. Bank of America Merrill Lynch economists point out that growth in the stock of U.S. housing has been persistently below working-age population growth throughout the years since the recession.

Moreover, big home builders don’t have much of an incentive to seriously step up the pace of construction. They face less competition than they did in the past—many smaller operators were wiped out in the housing bust. And rising material and labor costs are a further disincentive for boosting production.”

Over the past few months though, the sales and inventory statistics have reversed trend. This might be a temporary blip, but there is reason to think that high prices in some of the hottest markets are causing buyers to pause and sellers to lower prices.

Here are a few snippets from a Bloomberg article on July 26, 2018, “The U.S. Housing Market Looks Headed for Its Worst Slowdown in Years”.

“Affordability is becoming a major headache for homebuyers,” said Lawrence Yun, the National Association of Realtors’ chief economist. “You are seeing home sales rising in Alabama, where things are affordable. But in places like California, people aren’t buying.”

Ed Stansfield, chief property economist at Capital Economics Ltd. in London. “People

are saying: Let’s just bide our time, there’s no great rush. If we wait six or nine months we’re not going to lose out on getting a foot on the ladder.” That means “we’re now looking at a period in which prices move more or less sideways, or increase no more quickly than growth in incomes, over the next few years.”

“While there appears to be a slowdown in the growth rate of home sales and prices, it has not slowed rising homeownership,” Freddie Mac Chief Economist Sam Khater said in a statement -- though he added that the rate is a full percentage point below the 50-year average, reflecting “the long-lasting scars from the Great Recession and the lopsided nature of this recovery.”