Economic and Market Update – Volatility & the KC Royals

What haven’t we seen for a while?

Financial market volatility and the KC Royals in the playoffs! But only the latter is unexpected and wonderful news! Go Royals! 1 and 1! We Believe!

Now onto the markets... The third quarter ended with the S&P 500 up 6.7% for the year. The returns for the latest quarter were almost flat. The index finished the quarter about 2% off its all-time high that it reached in the middle of September. Small cap stocks have had negative returns for the recent quarter and for the year to date. The Russell 2000 Index finished the quarter with a year-to-date return of -5.3%. We believe that it will be difficult for the S&P 500 index to make meaningful gains going forward without similar positive returns from its small cap cousins.

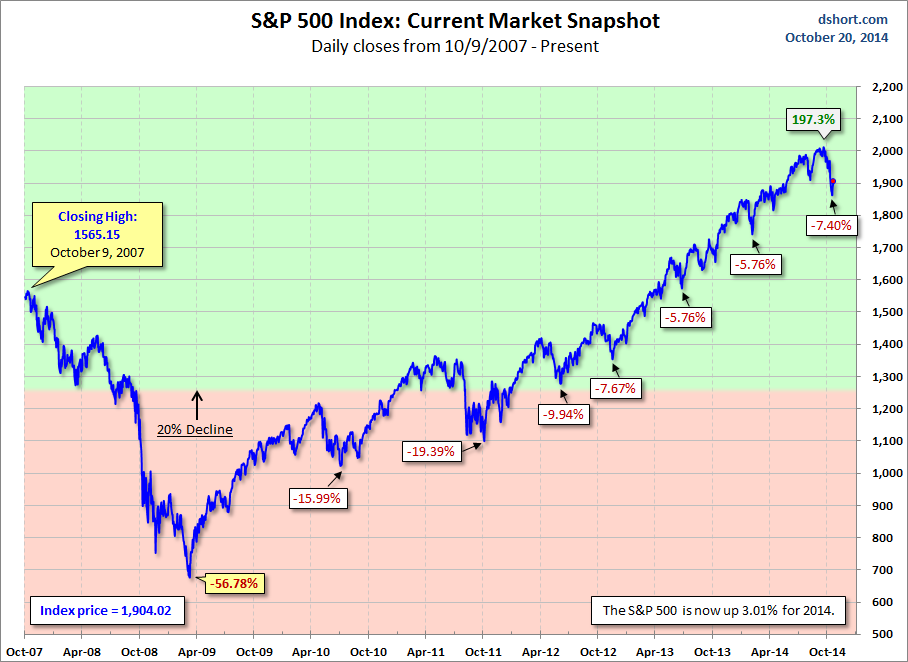

I am writing this in mid/late-October, and the equity markets have had increased volatility and a moderate decline. After a long period of unusually calm markets, volatility has returned to the market. These levels of volatility have not been seen since November 2011. However, this is not unexpected; and we commented in early August that the markets could experience the possibility of a pullback. Put into perspective, through October 16 the Dow Jones Industrial Average was down 6.7% from its September highs while the S&P 500 was down 7.4%.

Geopolitical tensions and fears that global growth is slowing, particularly in Europe and China, have pushed down investors’ appetite for global equities. The overseas markets continued to lag our domestic markets with the MSCI EAFE Index down nearly 5.2% year to date.

Downside risks to the global outlook include fear of Europe falling back into recession and the European Central Bank’s limited ability to support growth. Additionally, U.S. firms doing business in Europe may see weaker earnings, made worse by the stronger dollar. On the other hand, falling commodity prices, especially lower gasoline prices, should help support consumer spending growth in the U.S., Europe and nearly all other major economies, into 2015.

The S&P 500 Index has declined about 5.4% from the high set on September 19 of this year. This index is still up around 6.7% year-to-date. Historically, a 10% stock market correction happens about once a year. According to Capital Research and Management Company, the last 10% correction was in October 2011.

This current decline in the equity markets are not necessarily a precursor to a recession or a bear market, but we are aware this decline causes some investors heartburn, and if so we welcome you to call us to discuss your concerns and questions.

If you know someone who is in need of financial planning or investment advice during these interesting times, we would be happy to meet with them for a complimentary consultation.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Any opinions are those of Alex Petrovic and Alex Petrovic III and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

MSCI EAFE Index is an index, with dividends reinvested, representative of the securities markets of 20 developed countries in Europe, Australasia and the Far East. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.