Bear Market Conversations

Over the last few years, we have been preparing ourselves and you for a potential recession and bear stock market. Little did we know this bear market might come from a viral pandemic, BUT we did recognize any major shock, financial or otherwise, could potentially derail our slow growth interconnected global economy.

Because we have had extensive recession and bear market conversations in the context of your unique financial situation, we believe we have prepared you accordingly for whatever lies ahead.

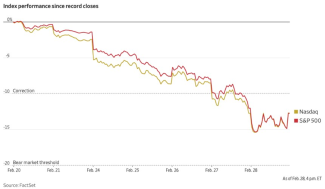

It is certainly possible this pandemic could cause a global recession and prolonged stock bear market. However, given that the world is at the initial stages of this, and the current stock market pullback is 100% based on speculation and little real data, it is also possible COVID-19’s impact will be felt over the next 3-6 months, with an economic and stock market recovery close behind.

Therefore:

- For our long-term investors, with time horizons more than 1 year we presently recommend you continue to stay the course.

- For those of you who are presently taking portfolio distributions, we will consult with you when you request additional withdrawals, or when we have our next client meeting, if it makes sense to sell only the bonds in your portfolio to fund the distribution, so we give our stocks time to rebound. This strategy may not fit every client, but it could be one way to avoid selling stocks while they are down.

- For those of you interested in “buying stocks on the dip”, please call to speak with us. Since there is very little information on which the financial markets are moving, it is very possible stocks will fall further until real, actionable data materializes. With that said though, adding to stocks in the near future could be a good long-term strategy.

Bottom line: Because of the ongoing conversations we have had over the past couple of years, in general we are not recommending clients sell stocks at this time.

As always, please call if you have questions or just want to talk. Both Senior Advisor Jim Stoutenborough and I are ready to chat at any time.

As you would expect, every day we continue to monitor the situation for indications of broader economic impacts and to share any developments with you. We hope the global response to contain the respiratory disease proves effective and will slow its spread. We wish you good health and encourage you to visit cdc.gov to learn about pragmatic measures that could help protect you and your family, especially if you have travel plans.

As always, please reach out to us with any questions you may have, and thank you for your trust in us.

Alex Petrovic III, CFP®

President